Loans

Student Loans

ICC participates in the Federal Direct Loan program. Federal Direct Student Loans may by borrowed by qualified students enrolled at least half-time in eligible certificate or degree programs. Federal Direct Student Loans are to be repaid by students regardless of whether the student is successful in completing the program of study or obtaining employment.

General Information about student loans may be found at the following:

- Federal Student Aid information

- Loan Counseling, Application and Repayment

- Student Loan Repayment

- ICC Student Loan Code of Conduct for ICC, its Employees and Affiliated Organizations

Federal Direct Subsidized Loans

- Subsidized loans are need-based loans calculated using your Expected Family Contribution (EFC) from the FAFSA, your cost of attendance and other eligible financial assistance.

- Interest on your student loan is paid by the government while you are in school, as long as students complete their program of study. Subsidized loans are the preferred loans because of this benefit.

- Payments are deferred until students graduate, leave school or fall below half-time enrollment.

Federal Direct Unsubsidized Loans

- Unsubsidized loans are not need-based loans calculated using your cost of attendance and other eligible financial assistance.

- Unsubsidized loans will accrue interest while in school.

- Payments are deferred until students graduate, leave school or fall below half-time enrollment.

Federal Direct Parent PLUS Loans

- A parent of a dependent student may apply for a Parent PLUS Loan

- General information about Federal Direct Parent PLUS Loans may be found here

- To apply for a Federal Direct Parent PLUS Loan, the parent must complete the Parent PLUS Loan application online at https://studentaid.gov/plus-app/.

- Parents requesting a Federal Direct Parent PLUS Loan will be contacted by the Office of Student Financial Aid by email once the request has been received.

Accepting (Borrowing) Federal Direct Student Loans

- Student may accept (borrow) student loans by accepting the desired loan amount in their Online Financial Aid System or by completing a Loan Adjustment Request Form in our office.

- The student should navigate to the “Accept My Awards” section, input the amount of loan request, accept the award, and submit the acceptance to our office.

- Traditionally, Federal Direct Student Loans are offered as an annual award, i.e., a loan to cover both the fall and spring term. Therefore one-half of the requested amount will be disbursed to the student in the fall and the other one-half will be disbursed to the student in the spring.

- First time borrowers must complete Direct Loan Entrance Counseling and are subject to a 30-day waiting period from the start of their enrollment period before loan proceeds will disburse.

- All borrowers must complete or have an active/unexpired Master Promissory Note (MPN).

Accepting (Borrowing) Federal Direct Parent PLUS Loans

- Parent borrowers may indicate the requested amount within their online application.

- Parent borrowers who do not indicate a requested amount will be contacted by the Financial Aid Office to document the requested amount.

- Parent borrowers must complete or have an active/unexpired PLUS Master Promissory Note (MPN).

All borrowers must complete Exit Counseling when transferring from or otherwise not returning to ICC or if the student’s enrollment level falls below half-time. This also applies to student borrowers who have withdrawn from ICC.

Students are notified to their personal email address as indicated on their FAFSA (where applicable) and to the student's ICC email. If our office does not have your personal email address, exit counseling notices will be sent to your address of record.

How to Enter Repayment

- Students with questions about repayment should refer to the U.S. Department of Education's Student Loan Repayment site for the most up-to-date information about repayment options.

- The U.S. Department of Education also provides borrowers with a Loan Simulator tool that can educate borrowers about repayment options.

- As a borrower, you have the right to access your student aid record, including loan records, via the National Student Loan Database Service at https://nslds.ed.gov. For information about how to access your financial aid record, you can also contact the ICC Financial Aid Office.

How to Avoid Loan Default

- ICC partners with Wright international Student Services (WISS) to assist students with entering repayment and avoiding default.

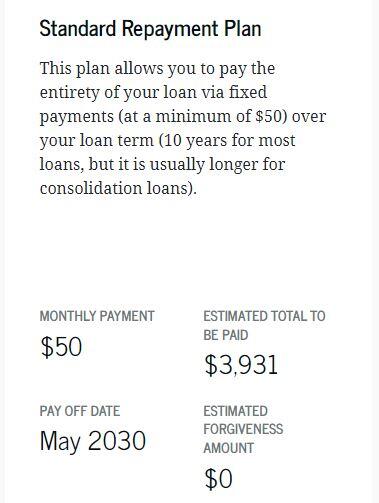

Example Repayment Plan

- The median student loan debt for ICC student borrowers as of the 2022-23 award year,

is $3,464. A student could enter into a Standard Repayment Plan to pay off the balance

within 10 years (the shortest repayment plan option) and expect the following: